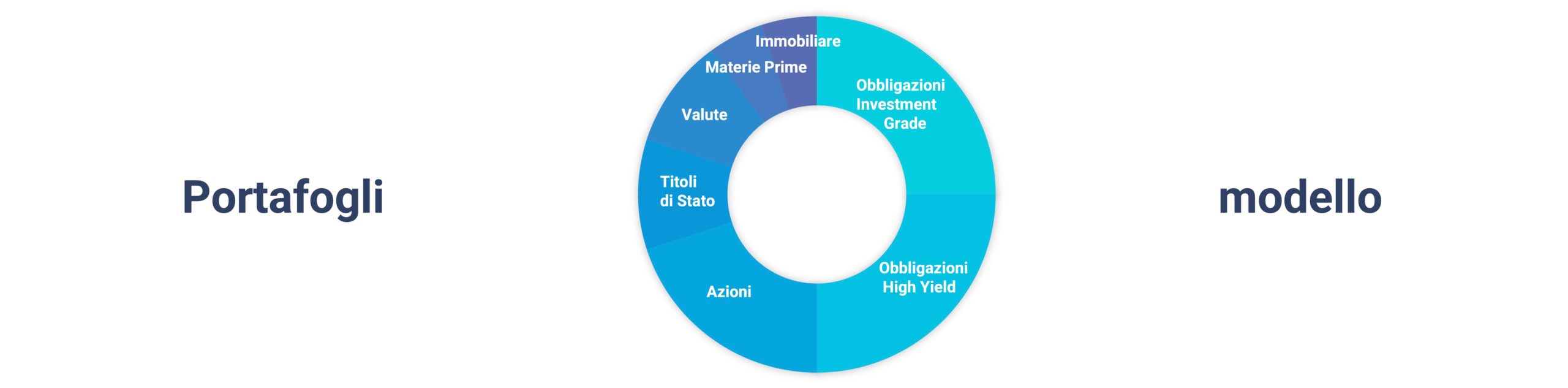

Standard portfolios are baskets of securities where the choice of securities and the weight of the various asset classes is chosen to achieve different degrees of investment risk.

Each portfolio adopts different strategies and prefers to invest in certain instruments and asset classes.

It is up to the investor to choose the portfolio that is suitable for his/her risk profile, as well as for his/her objectives and investment time horizon.

This service is an informative support available to “do-it-yourself” investors who want to receive ideas and investment signals from our Research Department and operate independently.

This service is aimed at savers with assets up to 100,000 euros, who cannot access our personalized advice (accessible only for those with assets over 100,000 euros), who want to follow our diversified and flexible investment approach.

There is no minimum capital but it is advisable to have a capital of at least 20,000 euros, otherwise the subscription cost would affect the return too much.

For those who have a capital of less than 20,000 euros, we recommend the INTELLIGENT PAC service that guides you in the construction of an investment portfolio as you save money.

Subscribing to a model portfolio means receiving a list of all the securities in that portfolio and a newsletter when there is any change in the portfolio to take advantage of market developments.

Investors can easily replicate our portfolios with their bank because they are composed of listed instruments, available in any home banking: the Etf’s and Etc’s.

The portfolios are constructed on the basis of quantitative methodologies. Variations in the weighting of the various asset classes and changes in securities take place according to macroeconomic changes, the fundamentals of countries and companies and price trends. In this regard, please refer to the section “Management method” where our methods of analysis and selection of securities are explained in detail.

This editorial and generic consulting service is not to be intended as personalized advice and is therefore not subject to the supervision of Consob nor of the Organism of supervision and maintenance of the Single Register of Financial Consultants (OCF) since it is an ancillary service provided by Alessandro Busnelli.

All the opinions provided in the generic consultancy services are addressed to an indistinct public and within our generic consultancy services, the opinions expressed are never based on the specific consideration of the needs and characteristics of a specific investor.

The analyses are carried out exclusively on the financial instruments object of the service in a logic of overall portfolio.

The past performance of our model portfolios cannot be, under any circumstances, a reliable indicator of future returns or capital gains because all investments in the financial markets involve risks.

As required by fairness regulations, we therefore repeat that you should refer to the Warnings section for all relevant information on risks and the type of analysis provided in our ancillary services.